SEPTEMBER 2025 REVIEW

Dear Investor,

Independent Securities’ Worldwide Flexible Fund experienced an interesting journey in September, seeing all-time-highs mid-month, followed by a slight pullback at the end of the month, characteristic of a moderate to high-risk fund with a long-term investment horizon. Ups and downs are to be expected, indicating a healthy fund that is aligned with its investment mandate. As Charlie Munger famously said:

“The big money is not in the buying and the selling, but in the waiting.”

Marginal volatility was seen due to short-term fluctuations in some of our larger, high-conviction holdings, and, as we continue to analyse and stress-test our allocation, our investment thesis remains intact. We proudly note that the fund is ranked in the first quartile among its peers over the last 3 years, returning 19.6% annually.

Aligned with our investment philosophy which focuses on high quality businesses with wide moats, and durable valuations, we view these recent fluctuations as price volatility, presenting opportunities to reinforce our confidence in the value, resilience, and long-term growth prospects of our portfolio.

Our investment stance remains the same: ignore the noise, stay calm, stay selective, and let quality compound.

Market Commentary

Global markets continued to navigate shifting macro currents in September. The U.S. Federal Reserve cut interest rates by 25 basis points, its first reduction since 2024, and signalled the likelihood of two additional cuts before year-end. Historically, the twelve months following the first cut of a cycle have been constructive for equities, as lower borrowing costs and improved liquidity provide a tailwind for corporate earnings.

Meanwhile, headlines surrounding a US government shutdown generated noise but little impact, across 22 shutdowns since 1976, the S&P 500 has averaged flat to positive performance during these episodes and have tended to advance in the year thereafter.

On that note, veteran investor Leon Cooperman recently cautioned that we may be entering the exuberant late stage of this bull market, echoing Warren Buffett’s 1999 observation:

“Once a bull market gets under way… a crowd is attracted into the game that is responding not to interest rates and profits but simply to the fact that it seems a mistake to be out of stocks.”

We share Cooperman’s awareness of elevated valuations in certain hot areas (AI among them), but our investment philosophy is built for precisely such environments. By staying disciplined, focusing on quality businesses and long-term fundamentals, we aim to capture durable growth while avoiding late-cycle euphoria. As ever, we remain vigilant yet optimistic, navigating the cycle with a calm, confident hand.

Fund Holding Highlights

Constellation Software, Topicus & Lumine Group: Our holdings in Constellation Software (CSU) and its listed spin-offs, Topicus and Lumine, were the primary source of interim volatility in the month of September, following a short-term sell-off after founder Mark Leonard stepped back from his executive role for health reasons. Markets tend to react first and analyse later when leadership changes occur, and we view this drawdown as sentiment-driven rather than fundamental.

Constellation is a rare long-term compounder with its share price rising more than 250-fold since 2006, built on a deeply decentralised model that empowers over 700 autonomous software businesses.

This structure, coupled with a rigorous capital-allocation framework, has created one of the most resilient and consistently profitable ecosystems in global software. The succession plan was internal and well-prepared: long-time COO Mark Miller, with more than two decades at the firm, assumed the presidency.

Management’s credibility was further reinforced as senior executives purchased shares during the decline, underscoring confidence in the company’s long-term trajectory.

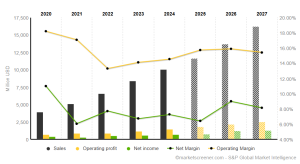

CSU: Projected Income Statement

(Source: Market Screener – S&P Global Market Intelligence)

Importantly, Constellation’s leadership reaffirmed its disciplined approach to capital deployment and AI adoption. Rather than chasing hype cycles, the group invests only where it sees enduring business impact and strong return potential, the same prudence that has driven its success for nearly two decades.

We believe the recent weakness offers opportunity, not concern. The culture that built Constellation’s remarkable track record remains intact, and its spin-offs continue to demonstrate the cash-flow resilience and capital-allocation excellence that define this enduring franchise.

Nu Holdings: Nu Holdings, the parent of Latin America’s leading digital bank Nubank, experienced some share-price softness in September amid competitive noise in Brazil’s e-commerce and consumer-credit markets. Amazon’s seasonal promotional push and aggressive pricing sparked concerns over margin pressure across the region’s fintech space. As with Constellation, we view this as sentiment-driven volatility rather than a shift in fundamentals.

Nu’s underlying performance remains exceptional. The company now serves more than 120 million customers across Brazil, Mexico, and Colombia, one of the largest retail banking footprints in the world and continues to grow revenue at roughly 20 – 40% year-on-year.

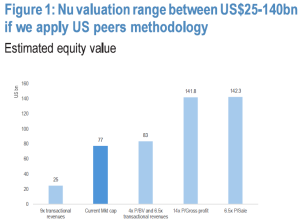

Profitability is expanding, with returns on equity exceeding 50% in its core market and credit losses normalising as customer cohorts mature.JPMorgan recently reaffirmed its positive stance on Nu, noting that the pullback offers an attractive re-entry point and highlighting the firm’s projected 28% revenue compound annual growth rate through 2027. We concur with this sentiment as Nu’s scale advantage, low-cost digital model, and brand affinity create powerful network effects that should sustain long-term growth.

(Source: JP Morgan)

While near-term competition may introduce noise, Nu’s fundamentals remain firmly intact. The company’s disciplined execution, product diversification, and strong balance sheet underpin our conviction. We continue to view Nu as a core holding in the global fintech space, with the recent weakness presenting opportunity rather than concern.

Other Technology Holdings (ASML, Amazon, Sea Limited): Our technology exposures further presented a mixed picture in September. ASML, the Dutch semiconductor-equipment leader was a clear positive contributor. After a softer start to the year, ASML’s share price has rallied nearly 50% year-to-date, driven by renewed enthusiasm for AI and sustained semiconductor-capital-expenditure demand. The company’s order backlog now extends several years, underpinned by its near-monopoly position in extreme-ultraviolet (EUV) lithography, the essential technology enabling advanced chip production.

This rally illustrates the strength of owning irreplaceable, high-barrier-to-entry businesses. ASML remains a cornerstone holding given its exceptional margins, cash generation, and leadership in next-generation chip manufacturing.

By contrast, Amazon and Sea Limited saw short-term softness. For Amazon, concerns about retail investment cycles and competitive intensity temporarily overshadowed solid momentum in AWS and advertising. Sea faced renewed focus on e-commerce pricing and gaming trends, yet management continues to execute with improving cost discipline and expanding margins. In both cases, we view the recent moves as technical, not structural. These companies remain global leaders positioned to benefit from the next leg of digital and AI adoption.

Closing Remarks and Looking Ahead

Periods such as September serve as useful reminders of why process and discipline matter. Market pullbacks, even brief ones, test conviction, but they also create opportunity and we continue to focus on the underlying strength of our businesses rather than the daily movements of their share prices. Each holding in the portfolio competes for capital against our highest-conviction ideas, and we continually assess position sizes to ensure balance between concentration and risk management.

Looking ahead, the macro environment, characterised by declining policy rates and resilient earnings, continues to provide a constructive backdrop for quality equities. While we remain alert to late-cycle exuberance in certain segments, we are confident that our emphasis on fundamentals will continue to serve investors well.

Short-term volatility is the price of long-term participation. By staying patient, selective, and valuation-aware, we believe the fund is well placed to compound value steadily over time.

We thank you for your continued trust and partnership.

Please feel free to reach out with any questions or thoughts. We are here to assist and to ensure you stay informed about your investment.

Sincerely,

Joe Klopper CSb(SA)

Fund Manager

1. Performance disclosure: Annualised total return over the 3 years to 30 Sep 2025, Class A, calculated NAV-to-NAV, net of ongoing fees, with income reinvested. Source: MoneyMate, Morningstar/BCI. ASISA category: Worldwide Multi-Asset Flexible. Quartile/ranking based on Morningstar category peers for the stated period. Past performance is not a reliable indicator of future results.

Disclaimer: This document is provided for information purposes only and does not constitute investment advice, a personal recommendation, or an offer/solicitation to buy or sell any financial product. Collective Investment Schemes (unit trusts) are medium- to long-term investments. The value of participatory interests may go down as well as up, and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance. Where performance or rankings are shown, they relate to the Independent Securities BCI Worldwide Flexible Fund (Class D) on a NAV-to-NAV, net-of-ongoing-fees basis with income reinvested for the period stated; sources and dates are indicated alongside any figures quoted. The Fund may invest offshore and is therefore exposed to currency, political and macroeconomic risks. Any forecasts, targets, illustrations or hypothetical returns are not guaranteed, are for illustrative purposes only, and depend on market conditions and underlying asset performance. Information has been obtained from sources believed to be reliable, but no warranty is given as to completeness or accuracy and opinions may change without notice. Neither Independent Securities (Pty) Ltd nor its officers or employees accept liability for any direct or consequential loss arising from use of this material. This commentary does not take account of the objectives, financial situation or needs of any specific investor, investors should seek independent financial advice before acting. Conflicts/interest disclosure: the Fund may hold, and Independent Securities and its staff may have interests in, securities mentioned; they may also trade for their own accounts. Independent Securities (Pty) Ltd (FSP 29612) is authorised by the Financial Sector Conduct Authority and is a member of the JSE. Boutique Collective Investments (RF) (Pty) Ltd is the registered manager of the scheme. A detailed schedule of fees, charges and risks is available in the latest Minimum Disclosure Document (MDD).