AUGUST 2025 REVIEW

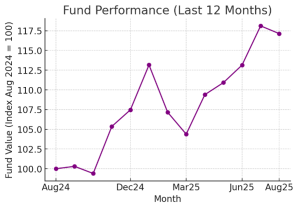

We are pleased to report that the Independent Securities BCI Worldwide Flexible Fund’s value has risen steadily over the past year, despite significant market volatility and mid-year fluctuations. The fund’s annualised performance was sustained at 18.2% over the past two years, with a 1-year return of 17.7%, comfortably outperforming peers.

These strong trailing returns underscore the fund’s ability to navigate choppy markets while adding value for investors. The fund’s year-to-date performance stands at 9.13%, reflecting stable gains amid 2025’s near-historic unpredictability.

August itself was a quieter month for us, reflecting earnings-season swings, a stronger rand and an expected softer patch in several large holdings. Despite market ructions, with sharp peaks and troughs, the fund remains on a steadfast upward trajectory, illustrating the resilience of our strategy. This outperformance validates our emphasis on quality holdings and patience in the face of market swings. Confirming that our unwavering commitment to a disciplined approach translates into robust growth for investors, over both medium and longer terms.

To echo the sentiments of Ray Dalio:

The greatest mistake of the individual investor is to think that a market that did well is a good market, rather than a more expensive market.

We urge investors to avoid chasing the greed of indiscriminate market winners, just as we continue to search for fundamental value and durable growth, impervious to market hype and predictions of the disparate extremes of animal spirits.

Our Investment Philosophy in Practice

At Independent Securities, our approach is rooted in high conviction, long-term orientation, and disciplined asset allocation. We don’t chase short-term narratives or panic during pullbacks. Instead, we focus on a concentrated set of businesses with durable competitive advantages, strong capital allocators, and clear intrinsic value.

We are unapologetically long-term. When a quality business hits a rocky quarter, but the underlying thesis remains intact, we view it as an opportunity, not a reason to exit. Our willingness to be concentrated means that our top positions, are meaningful allocations, not marginal slices.

This approach sets us apart. While many funds mirror broad indices or react to momentum, we do the opposite: we hold fewer names, do deeper research, and let time do the compounding. In our view, true outperformance requires patience, discipline, and a willingness to be different, especially when markets are volatile.

Our flexible mandate allows us to invest globally across asset classes. We deploy that flexibility deliberately, shifting between assets, based on where we find the most compelling long-term return per unit of risk.

Market Commentary

Markets are all about interest rates at the moment, and we continue to monitor moves to inform our strategic alignment. Investor positioning continues to follow the path of inflation, bond yields and central bank guidance. Rate outcomes matter because they reset the discount rates that asset allocators seek to pursue gains, they also change the opportunity cost of cash. Where policy looks set to ease, risk assets typically breathe easier; where policy looks stickier, earnings multiples compress and equity leadership narrows. Current expectations indicate that rate cuts are expected, which should buoy market performance and affect our offshore portfolio positively.

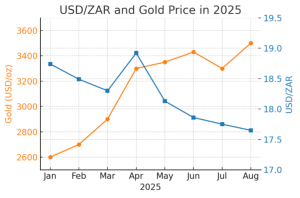

An outstanding macro trend for the year, and in August, has been highlighted by the gold price, which strengthened to all-time highs as investors sought safer havens against headline risks. These gains are also set against the backdrop of a weakening dollar, and while constructive for local inflation expectations, this translates into a headwind for our offshore assets in ZAR terms. While currency effects do not change intrinsic value; they do impact month-to-month positions.

Fund Holding Commentary

Earnings season brought its usual mix of beats, cautious guides, and knee-jerk moves. Across the book, our thesis remains unchanged, our portfolio continues to be concentrated in high-conviction positions across technology, consumer and real assets.

- Amazon (AMZN): Amazon remains a core holding. The company’s latest results underscore the strength of its cloud and advertising businesses, which are growing briskly. While the stock has experienced bouts of volatility (partly on interest rate fears and sector rotation), we view Amazon’s dominant AWS cloud platform and its burgeoning ad revenue as twin engines that will drive future cash flows. We stayed the course during this year’s swings, and the fund benefited as Amazon’s share price recovered with improved market sentiment.

- Constellation Software, Topicus and Lumine Group: Our conviction in Constellation Software (and its spin-offs Topicus and Lumine) has only strengthened. Constellation’s proven strategy of acquiring niche software businesses at attractive valuations continues unabated, and the creation of Topicus and Lumine has unlocked additional value, where our holdings have already seen handsome returns. We participated in these spinoffs due to our confidence in management’s capital allocation. All three companies exemplify our preference for businesses with predictable cash flows and savvy management.

- Builders FirstSource (BLDR): Rising interest rates have cooled US housing activity, which in turn has weighed on Builders FirstSource (a leading supplier of building materials). Our view, however, is that BLDR has shown remarkable resilience. Despite a tougher environment for new home construction, the company has benefited from the ongoing demand in repair and remodeling, as well as structural underinvestment in housing stock (which supports renovation spending). The stock saw pressure when rate fears spiked but has since stabilized. We continue to hold BLDR with the conviction that pent-up housing demand and the company’s operational strengths (like cost controls and pricing power in key products) will enable it to weather the interest-rate cycle and thrive in the long run.

- ASML (ASML): The fund’s exposure to semiconductor technology is primarily through ASML, the Dutch maker of lithography machines essential for chip fabrication. ASML faces near-term uncertainty from macro downturns and export restrictions (notably, limits on selling advanced tools to China). These factors have occasionally weighed on its stock. However, we remain focused on ASML’s long-term secular tailwinds: the insatiable demand for high-end chips powering AI, data centres, and advanced electronics. As the sole provider of extreme ultraviolet (EUV) lithography equipment, ASML enjoys a monopoly-like position in a critical industry. We are prepared to tolerate some volatility here; any weakness on geopolitics or cycle timing, in our view, is an opportunity to accumulate a stake in one of the world’s most indispensable tech companies.

- Sea Limited (SE): The Southeast Asian tech conglomerate, continues to demonstrate rapid momentum across all three of its business units. Recent results show resilience and renewed strength. E-commerce is expanding vigorously with improving unit economics, driven by management’s focus on profitability and efficiency. SeaMoney, the digital finance arm, is delivering exceptional growth and deepening its market penetration, while Garena’s gaming segment has rebounded strongly post-COVID, generating significant cash flows to fund new initiatives. Although the stock remains volatile given shifting sentiment toward emerging-market tech, we remain confidently bullish on Sea’s long-term prospects. Its diversified growth engines, disciplined capital allocation, and unique positioning in high-growth markets make it one of our high-conviction holdings.

- Brookfield Corporation (BN): In times of uncertainty, we find comfort in Brookfield’s steady approach. BN is the parent company of the Brookfield Group and owns roughly 75% of Brookfield Asset Management (BAM), the fee-based, “asset-light” manager, Brookfield also deploys its own balance sheet across real assets and an expanding insurance platform. This mix gives BN two engines of compounding: its majority stake in BAM, with fee-related earnings up about 16% year-on-year, and BN’s own invested capital and insurance earnings, supported by record deployable capital of around $177bn. Brookfield’s scale and liquidity position it to play offense in dislocations, harvesting returns where pricing is full and leaning into areas of structural demand, while shareholders participate both through BN’s direct returns and its share of BAM’s fee growth.

- Cash and activity: Following June and July we kept trading muted and cash measured, using volatility to add on weakness rather than chase strength. Optionality has value when headlines move prices faster than fundamentals.

Closing Remarks & Looking Ahead

As we move into the final stretch of 2025, we do so with cautious optimism. August has tested investors with its mix of rallies and reversals, but through it all, our message is consistent: remain calm and confident. There are reasons to be hopeful with the potential easing of interest rate pressures if inflation continues to trend down, as well as supportive policy in key markets, and innovative growth from our portfolio companies. Even as we remain vigilant about risks from geopolitical tensions and bumps to global market stability, rest assured, we will continue to manage the fund with the same steadiness and foresight that you expect from us.

Our investment committee is constantly researching, learning, and adapting, all with the goal of safeguarding and growing your wealth.

Disclaimer: This document is provided for information purposes only and does not constitute investment advice, a personal recommendation, or an offer/solicitation to buy or sell any financial product. Collective Investment Schemes (unit trusts) are medium- to long-term investments. The value of participatory interests may go down as well as up, and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance. Where performance or rankings are shown, they relate to the Independent Securities BCI Worldwide Flexible Fund (Class D) on a NAV-to-NAV, net-of-ongoing-fees basis with income reinvested for the period stated; sources and dates are indicated alongside any figures quoted. The Fund may invest offshore and is therefore exposed to currency, political and macroeconomic risks. Any forecasts, targets, illustrations or hypothetical returns are not guaranteed, are for illustrative purposes only, and depend on market conditions and underlying asset performance. Information has been obtained from sources believed to be reliable, but no warranty is given as to completeness or accuracy and opinions may change without notice. Neither Independent Securities (Pty) Ltd nor its officers or employees accept liability for any direct or consequential loss arising from use of this material. This commentary does not take account of the objectives, financial situation or needs of any specific investor, investors should seek independent financial advice before acting. Conflicts/interest disclosure: the Fund may hold, and Independent Securities and its staff may have interests in, securities mentioned; they may also trade for their own accounts. Independent Securities (Pty) Ltd (FSP 29612) is authorised by the Financial Sector Conduct Authority and is a member of the JSE. Boutique Collective Investments (RF) (Pty) Ltd is the registered manager of the scheme. A detailed schedule of fees, charges and risks is available in the latest Minimum Disclosure Document (MDD).